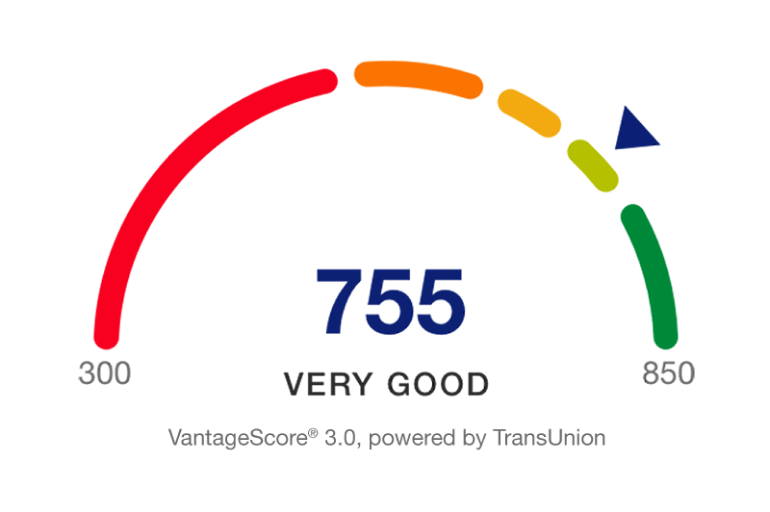

Improving your credit score can open the door to better loan terms, lower interest rates, and overall financial stability. While significant changes to your credit score can take time, there are several quick steps you can take to jumpstart the process. Although you won’t see overnight results, it is possible to boost your credit score within weeks by addressing the underlying causes of your low score and making strategic financial adjustments.

Common Reasons for a Low Credit Score

Understanding why your credit score is low is the first step toward improvement. Some common factors contributing to a low credit score include:

- Late or Missed Payments: Payment history accounts for a large portion of your credit score. Consistently missing or delaying payments on credit cards, loans, or bills can drastically lower your score.

- High Credit Utilization: Using a significant portion of your credit limit (e.g., high credit card balances) increases your credit utilization ratio, negatively affecting your score. Keeping your balances low relative to your credit limit is key to improving your credit score.

- Public Records: Items like bankruptcies, foreclosures, or tax liens on your credit report can have long-lasting effects on your score, sometimes staying on your report for several years.

- Loan Defaults: Defaulting on loans (e.g., student or personal loans) can severely damage your credit score, often leading to accounts being sent to collections.

- Identity Theft or Fraud: Unauthorised accounts or charges resulting from identity theft can lower your score. Regularly checking your credit report can help you catch any suspicious activity early.

Now that you understand the factors that may be lowering your score, here are actionable steps you can take to start improving it.

Steps to Improve Your Credit Score

- Dispute Errors on Your Credit Report A 2013 Federal Trade Commission (FTC) study found that about 25% of individuals had errors on their credit reports that could affect their credit scores. You are entitled to one free credit report annually from each of the three major credit bureaus. Review your report for inaccuracies and dispute any errors you find. Creditors typically have 30 to 45 days to verify the debt, and if they can’t, the negative item must be removed from your report.

- Increase Your Credit Limit You can lower your credit utilization ratio (the percentage of your available credit you’re using) by increasing your credit limit. You can request a higher limit on your current credit cards or apply for a new card. Just be careful not to overspend and maintain low balances. Be aware that applying for new credit may temporarily lower your score due to hard inquiries.

- Consolidate Your Debts If you have multiple debts, consider a debt consolidation loan. By consolidating, you’ll have only one monthly payment to manage, and a lower interest rate can help you pay down the debt faster. This will improve your credit utilization ratio and, in turn, your credit score.

- Hire a Credit Analyst If managing your credit seems overwhelming, you may benefit from hiring a credit analyst. Credit analysts are professionals who can review your credit report and implement personalized strategies to boost your score quickly. They may focus on reducing your credit utilization, correcting inaccuracies, or adding you as an authorized user on a long-standing account with a strong payment history.

Get Professional Help with Credit Analysts from Hackerscub

Improving your credit score takes time, but you can accelerate the process with expert help. Hackerscub offers professional credit analysts who can implement effective strategies tailored to your situation. For instance, they can help lower your credit utilization, correct errors (like late payments), or even add you as an authorized user on someone else’s account with a solid payment history and low utilization rate.

To get started, visit Hackerscub and speak to an expert via the button on the homepage.